Why silver prices could test $50 within a year

(SIY00) (SIN24) (SLV) (SIL) (PAAS) (WPM) (SSRM) (AG) (MAG)

by Jim Roemer – Meteorologist – Commodity Trading Advisor – Principal, Best Weather Inc. & Climate Predict – Publisher, Weather Wealth Newsletter

- Memorial Day Weekend Report: May 24-27, 2024

Silver plays a crucial role in the global green economy, particularly in renewable energy technologies and sustainable practices. With more global weather extremes and record-warm oceans, environmental technologies that utilize silver will only grow in the years ahead.

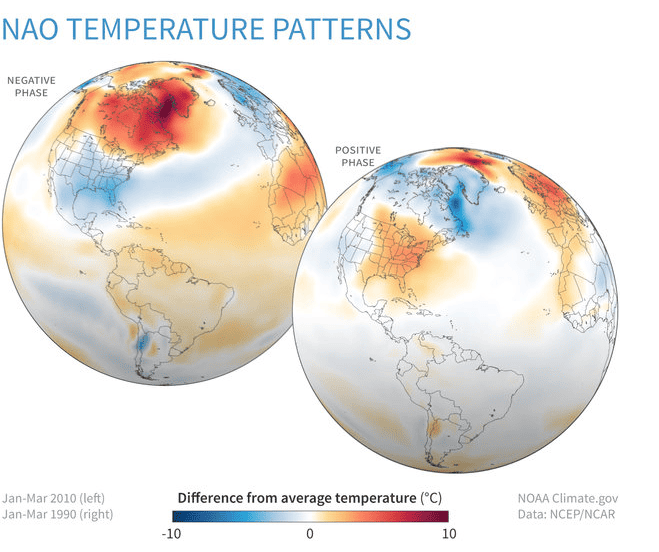

We have been slapped with unprecedented weather events: Historic snowfalls in California this winter and the rapid melting of Arctic ice. In addition, we have witnessed floods and landslides from Houston to southern Brazil.

The need for new technologies to combat climate change is being accelerated by only a few of the dozens of weather extremes.

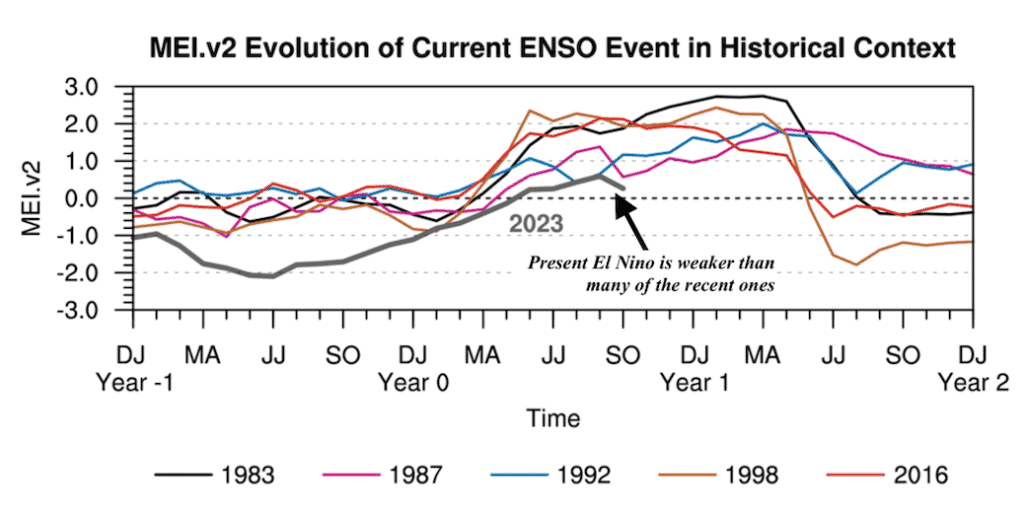

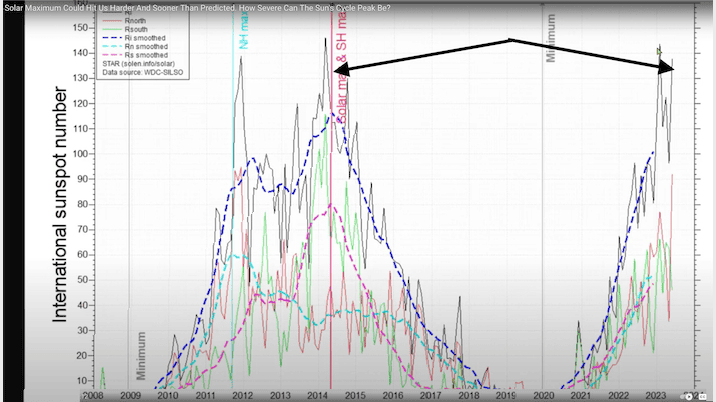

Just take a look at how record-breaking global ocean temperatures brought on climate change (to a greater extent than by El Niño) is opening the door for more silver-based technologies in the environmental sector.

We are seeing the silver market soar and the inevitable scenario is on the horizon for a $50 per ounce price tag.

Solar Energy: Silver is an essential component in photovoltaic (PV) cells built into solar panels. Silver paste is applied to silicon wafers that conduct the electricity generated from sunlight. In 2020, over 100 million ounces of silver were consumed in PV cells for solar energy. As the world transitions to renewable energy sources, demand for silver in solar panels is expected to grow significantly.

- E l e c t r i c V e h i c l e s: Silver is widely used in automotive electrical systems due to its excellent conductivity. Nearly all electrical connections in modern automobiles, including those in electric and hybrid vehicles, are outfitted with silver-coated contacts and membrane switches. The rise of electric vehicles will drive increased silver demand.

- W a t e r P u r i f i c a t i o n: Silver is used in water purification systems, both residential and commercial, due to its antibacterial properties. As the green economy emphasizes sustainable water management, the use of silver-based water purifiers is likely to increase.

- R e n e w a b l e E n e r g y S t o r a g e: Silver is a key component in batteries used for storing energy from renewable sources like solar and wind. The growth of renewable energy will necessitate more efficient energy storage solutions, boosting silver demand.

- A n t i b a c t e r i a l A p p l i c a t i o n s: Silver’s antimicrobial properties make it valuable in various green applications, such as textiles, bandages, and medical equipment, reducing the need for harmful chemicals.

When it comes to weather forecasting and my commodity analysis, I don’t write about the technology in the business of artificial intelligence. Nevertheless, silver has several important applications related to AI.

Silver is an excellent conductor of electricity, making it essential for electronic components in AI systems like computer chips, circuit boards, and interconnects. Its high electrical conductivity allows for efficient data transfer and processing. It is used in memristor devices, which can mimic the behavior of biological neurons and synapses. Memristors made with silver nano-wires can form artificial neural networks for neuromorphic computing, a brain-inspired approach to AI. Silver nanoparticles and nano-wires are being researched for use in random access memory (RAM) and non-volatile memory devices that could enable faster and more energy-efficient AI hardware.

As I mentioned above, silver is a crucial material in solar panels due to its superior electrical conductivity. Because AI systems require immense computing power and energy, solar panels with silver play a role in providing renewable energy for AI data centers.

So… in summary, silver’s unique properties make it an indispensable material in the global green economy, and AI technology, particularly in renewable energy expansion, sustainable water management, and eco-friendly applications that prioritize resource efficiency and environmental stewardship.

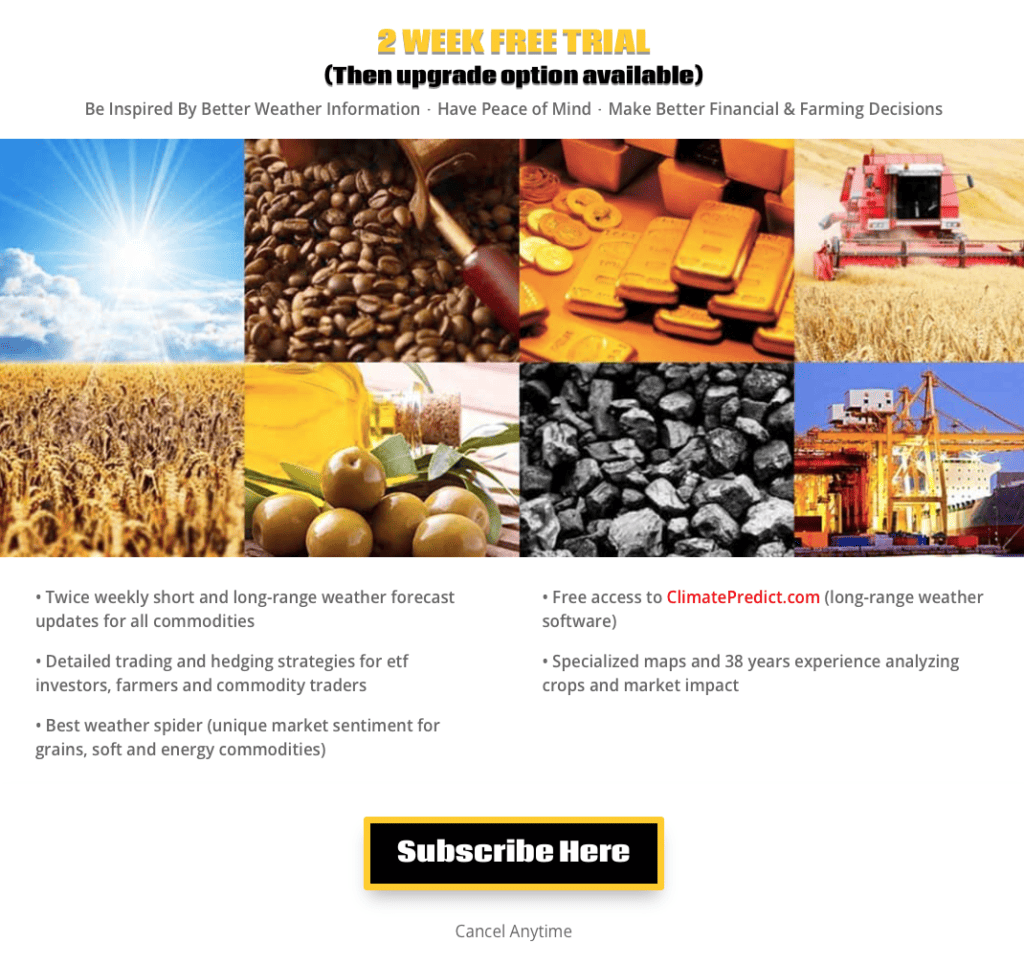

Join ETF investors, commodity traders, and farmers who want a huge advantage in understanding how the global climate is affecting everything from coffee and soybean futures to cocoa and even silver. Receive a 2-week free trial period to WeatherWealth. https://www.bestweatherinc.com/new-membership-options/

(The only all-global weather and commodity newsletter with trading ideas)

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and the Weather Wealth Team.

- Please feel free to learn about Jim Roemer, our track record, and how we use weather to help traders, hedgers, and investors. If you have any questions, please don’t hesitate to drop me a line – Scott Mathews, Editor

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involve a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results. There is no warranty or representation that accounts following any trading program will be profitable.

O