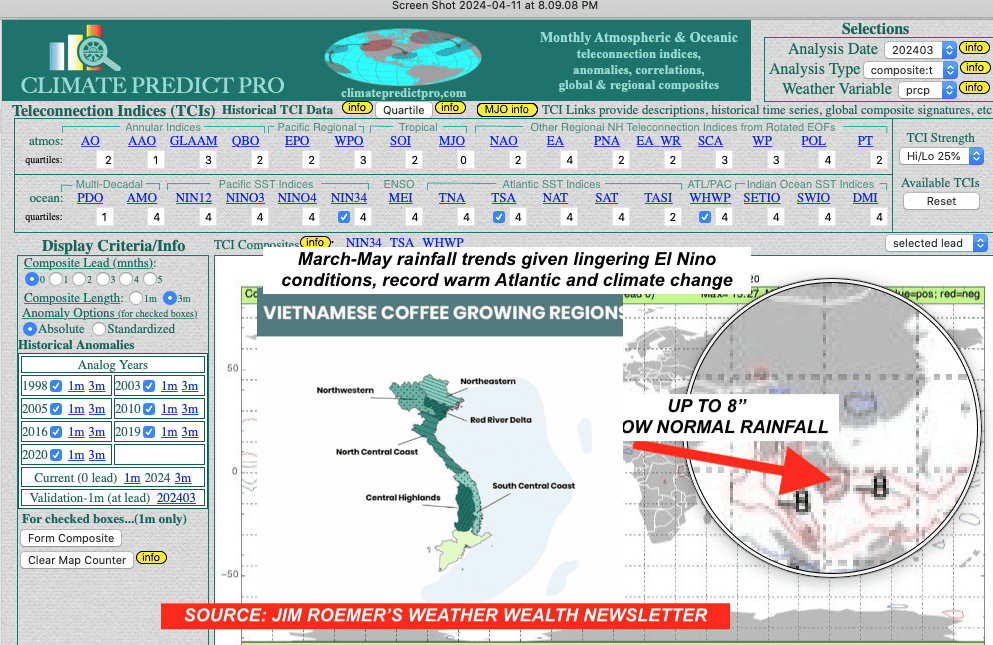

There’s a new bull market in town other than cocoa, gold, silver, and most recently crude oil (Middle East tensions and stronger global demand). It is coffee. Our WeatherWealth newsletter https://www.bestweatherinc.com/membership-sign-up/ advised clients close to a month ago about a potential severe drought developing for Robusta Vietnam crop regions (similar to the lingering spring El Niño conditions in 2016).

In contrast to other firms suggesting La Niña will form this summer, we have disagreed. In fact, some computer models just came out agreeing with our feeling that occasional weak El Niño conditions will persist until at least June or July.

So… how does that influence global coffee weather? For one thing, it may turn too wet for parts of northern Brazil’s coffee, following earlier heat and dryness in December-January. This was related.

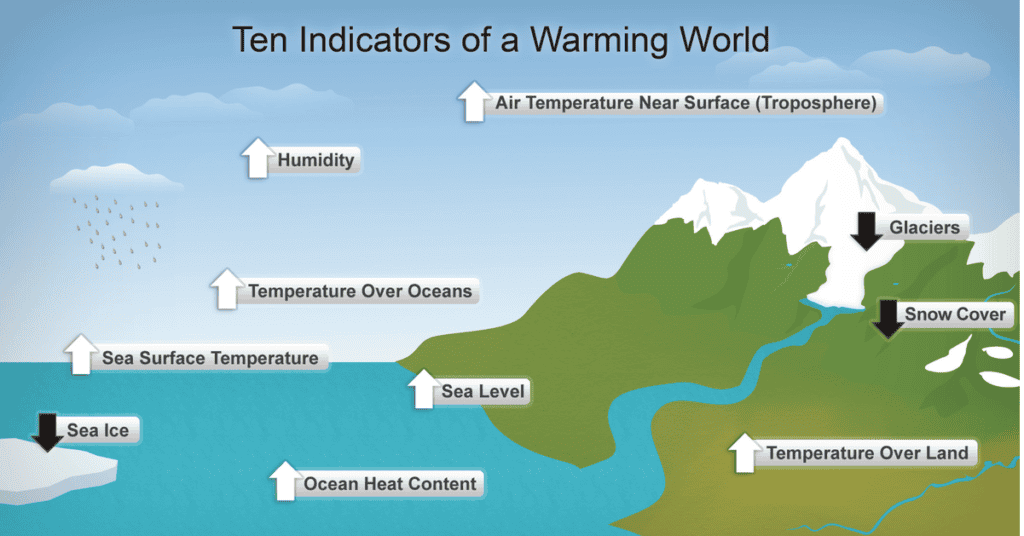

Not only due to El Niño but also to deforestation in the Amazon and climate change.

Source: EPA.GOV

However, of even greater concern is the continuation of record levels of tight Robusta coffee supplies. Irrigation levels are extremely low. Combine this with nearly record April heat (map below) and a pesky high-pressure ridge, and one can see why Robusta prices are testing historic high levels.

Another parabolic commodity move, similar to cocoa as the planet continues to warm

Consequently, will I change my forecast to more rain and a bearish outlook? How does one use coffee spreads, futures, or options to potentially capitalize on the lingering El Niño? That is where WeatherWealth comes in. Please feel free to click on the link at the top of the page for a 2-week free trial period covering all Ag and natural gas markets. You will also receive my BestWeather Spiders with trade sentiment for a dozen commodity products… for example: Robusta coffee advised a month ago.

The temperature index score is now very bullish at a +4 with record heat in Vietnam. This makes the total score very bullish at at least a +9.

Jim Roemer