Click here to play the video above.

What Gives With Natural Gas?

The historic volatility in natural gas continues. Last Friday, I told WeatherWealth clients about a major change in the weather pattern with a potential colder than normal late November and December. Natural gas prices proceeded to rally $1.00 from last Thursday’s lows and bearish EIA number to this Monday’s highs ($7.22) based on other firms changing their weather forecast.

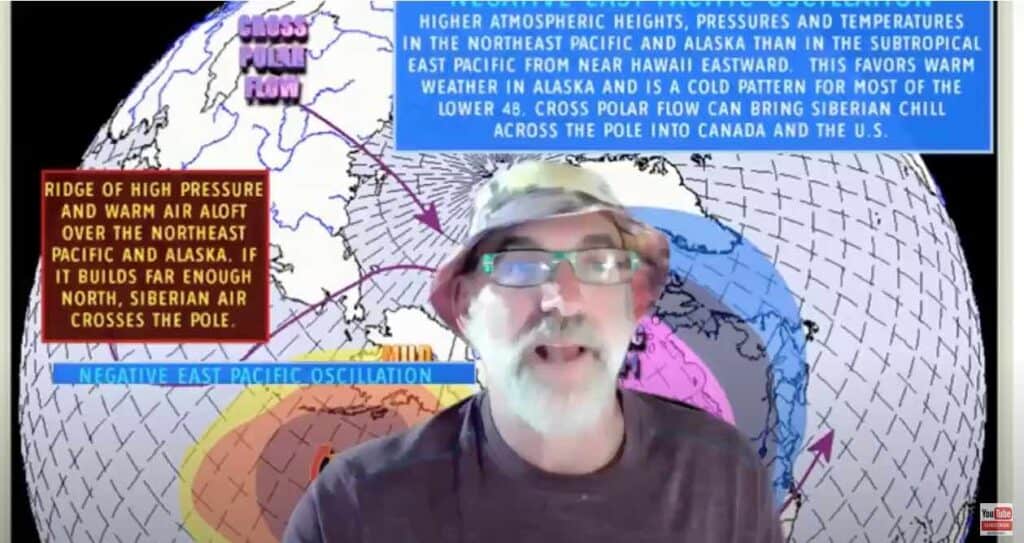

This video describes both La Nina and what we call a “negative Eastern Pacific Oscillation Index. The combination of these two climatic variables working together can produce a cold, early winter. Why then did natural gas prices pretty much give everything back in one day? Incredible.

Four Reasons for Natural Gas Moves

Here are the reasons I felt that natural gas (UNG) prices ran up too much, too quickly in the face of changing weather forecasts. After all, we had a near-record warm fall (globally) that has hurt natural gas demand. In addition, the main LNG export terminal in Freeport, Texas has been down for months.

1)Natural gas prices above $5-$6 this time of the year is very unusual as U.S. production continues to grow.

2) While the LNG export terminal will reopen soon, the weather forecast is warm for Europe. Hence, we need to see sustained cold weather, not just here in the U.S. but in Europe to help demand.

3) The weather last week was very warm across the United States and near-record temperatures this week. While potential colder late November and December weather could well occur, the natural gas market was anticipating another bearish EIA report this Thursday.

4) The European forecast models suggest that after just a week or so of U.S. cold, it will warm up again.

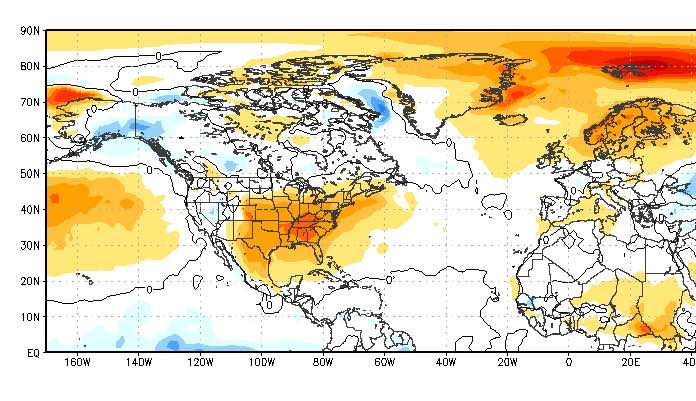

The European Model warms things up after Dec. 6 (red=warmer than normal). Source: Stormvista.com

Conclusion

So what to do in the natural gas market currently?

Based on extraordinary natural gas and weather volatility, using certain option positions is the way to go in this market. This is something we advised quite successfully in several commodity markets over the last few months.

Feel free to take a complimentary trial of our twice-weekly weather-commodity newsletter (Weather Wealth) and see this and many other reports. You can also learn how you can mimic our trade ideas in a new program called AutoTrade. All the information is here:

https://www.bestweatherinc.com/weather-profits/

Here are the headlines from one of our recent Weather Wealth reports.

REMEMBER, THERE IS A RISK IN COMMODITY TRADING. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.