(Our video from last week addresses why we reversed our bullish attitude in natural gas early this past week and enumerates the implications for South American grain weather.) It’s a bit too late to sell natural gas in the hole now, especially with a potential friendly EIA number later this week.

El Niño usually brings big crops to Argentina

It is common knowledge that more than 80% of the time, El Niño brings above the normal corn and soybean yields in Argentina and southern Brazil, but can often bring dryness and reduced crops in northern Brazil. This certainly happened earlier this winter (South American summer) with drought hurting Matto Grosso soybean yields. Nevertheless, we had been in the bearish camp for weeks in soybeans due to worries over the Chinese economy and our earlier forecast that South American weather and crop conditions would improve.

Click on this image

In the above video, I cover the following:

- A) Why late January and February heat and dryness in Argentina is unusual during El Niño but some problems may develop from excessive heat;

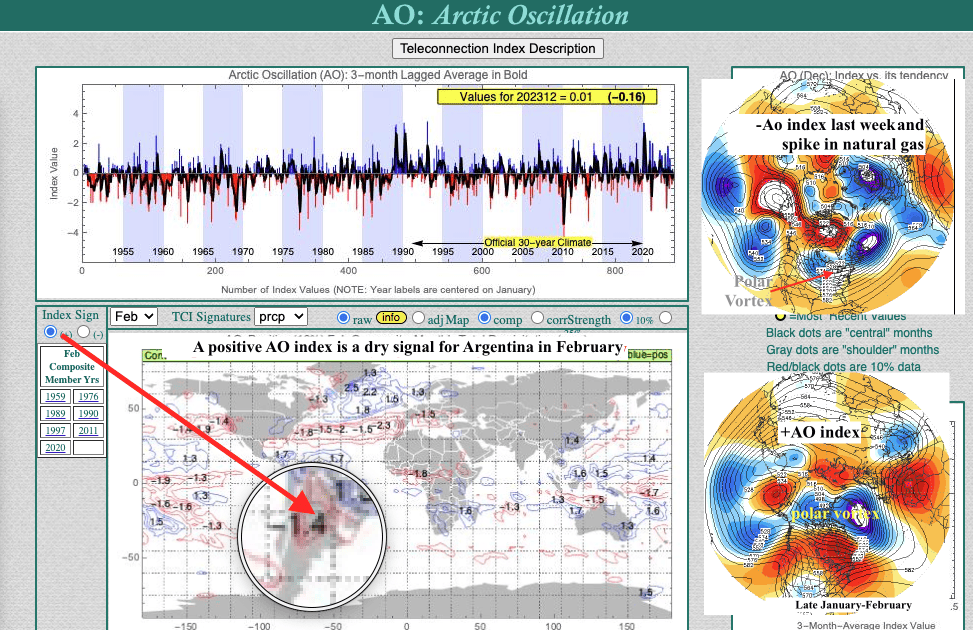

- B) How teleconnections such as the MJO and AO index can affect South American corn and soybean weather in February and offset typical ideal “El Niño type” weather (too wet at times for the northern Brazil soybean harvest and some potential minor issues resulting from hot and dry in Argentina);

- C) How we warned clients of a top in the natural gas market by predicting a +AO index;

- D) How the Red Sea tensions have helped markets such as Robusta coffee and cocoa soar. These two markets already have had tight supplies due to El Niño-related crop problems (Brazil coffee weather will continue to improve vs. some previous crop reduction issues);

- E) If February is hot and dry in Argentina, this might suggest that the 1987-88 El Niño analog could hold, suggesting the potential for summer Midwest weather problems affecting corn and soybeans (right now we are not calling for this, but something to watch).

f you have not yet had a complimentary trial to WeatherWealth, please request one, and join farmers, ETF investors, and futures traders on six continents and those who just want better (more accurate) short and long-range weather forecasts, often before markets react. While past performance is not indicative of future results, calling the $1 collapse in soybeans the last 6 weeks and the recent huge weather market natural gas volatility pays for the newsletter for years in just a matter of weeks.

Enjoy! Find out more here https://www.bestweatherinc.com/new-membership-options/