Possible Sell-Off in Commodities and Equities Coming?

Though it is not my job to normally discuss the stock market, it would. not surprise me in the weeks ahead that this virus could begin to “spook” the stock market. After such a major rally the last 10 years or so in equities, any sell off in stocks would also have a negative effect on most commodities

My concern right now is that the spreading of Coronavirus has not been digested by many commodities and even the stock market. While I do not claim to be a stock market expert, I have a strong hunch (based on watching market psychology for 35 years), that a potential Pandemic may cause a sell-off in stocks in the not too different future. While gold prices often rally in times of fear, it is possible that within the next month or so, gold prices may NOT react to the upside. There is a huge long position in the gold market and if this disease gets worse, selling of gold positions may be needed to raise cash.

.

Grains and Weather

Abundant moisture over the Plains/Midwest, Russia selling old crop wheat supplies into the world market, a record large Brazil crop and CoronaVirus have all offset any potential increase in China grain imports.

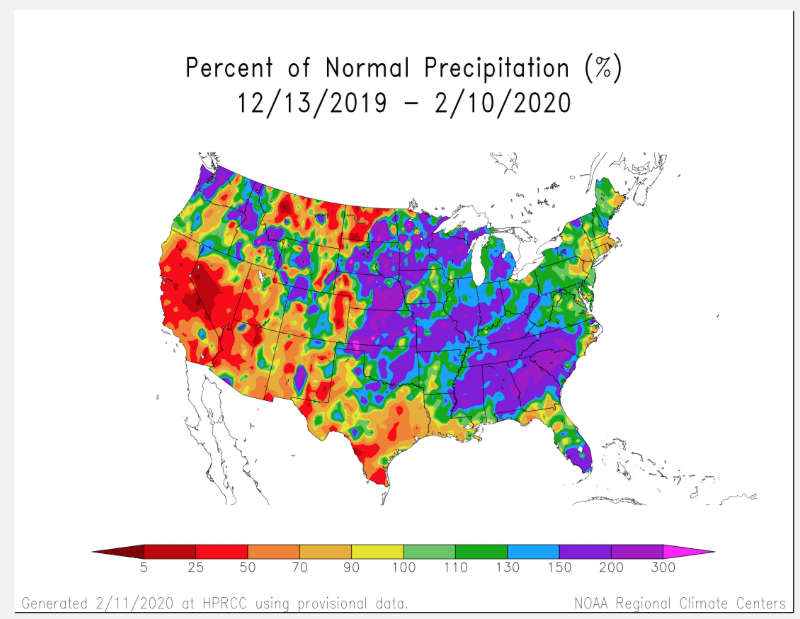

I have been in the camp since December, that drought easing rains in northern Brazil and a potential huge amount of exportable soybeans out of South American, could likely put the breaks on any sustainable rally in soybeans. In addition, excellent moisture across most of the Plains wheat areas (see below) this winter and the Midwest grain belt means that any preliminary spring US drought fears are highly unlikely.

All of these factors and a stronger dollar could, again have a bearish impact on commodity prices.

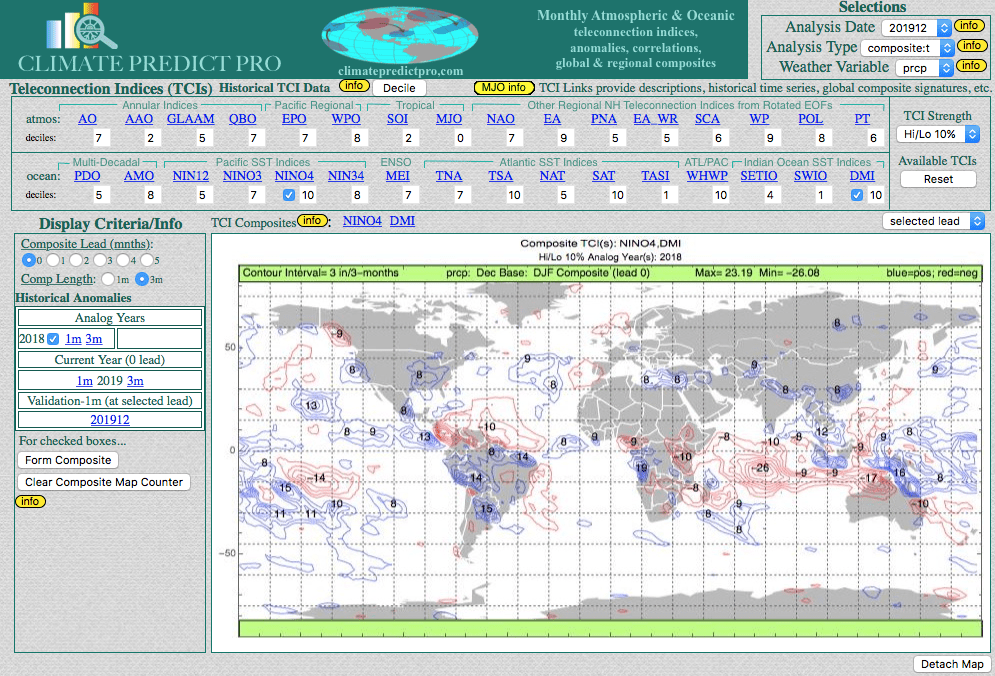

How did we forecast improved weather for South American soybeans and coffee close to two months ago? The great rainfall was one reason that coffee futures also fell some 40% from the November highs? It has to due to the previous positive Indian Dipole, and what we feel is still a weak El Nino signal.

Our CLIMATE PREDICT long-range weather forecast program (above) shows the forecast for December-February for a wet Midwest, dry west African cocoa and wet Brazil. This forecast has indeed come to fruition.

Wheat and Soybean Fundamentals

There is always a host of global fundamentals affecting the wheat market.

Soft-red wheat stocks are the tightest in several years and with US acreage down this year, any weather problem could spark a spring or summer rally in wheat. However, for now, one can see the great rains all winter in the Plains (map above), while the soft-red regions from Missouri to Illinois and Indiana are too wet. This could potentially some disease issues to the soft red crop, if there was to be a wet spring.

With respect to soybeans. The only weather concern that might be an issue would be with too much rain in northern Brazil for the harvest. It is way too early to worry about US weather problems, but one thing is for sure, that we will not be concerned about drought in the Midwest, at least through the spring.

There have been several years (1988, 2011, 2012) in particular, in which a dry winter and spring caused a bullish reaction in corn and beans prices quite early–even before planting. However, this will likely not happen this spring. A rally in grains will have to come from either wet spring weather and harvest issues and/or stepped up Chinese buying and an easing in the CoronaVirus scare.

Jim Roemer